- Žetta er einmitt ž.s. veriš er aš benda į, ž.e. aš stóra gengisfellingin sem margir bölva var ķ raun og veru jįkvęšur atburšur fyrir žann grunn sem allt stendur į, ž.e. atvinnulķfiš.

Bloggfęrslur mįnašarins, jślķ 2010

15.7.2010 | 20:24

Ömurleg staša Orkuveitu Reykjavķkur!

Eins og fram kemur ķ fréttum ķ dag, žį er Orkuveita Reykjavķkur ķ skuldakrķsu.

Sjį fréttir:

OR į ekki fyrir skuldum nęstu 3 įrin

Óhjįkvęmilegt aš hękka gjaldskrį OR um tugi prósenta fyrr en sķšar

Stórkostlegar gjaldskrįrhękkanir óhjįkvęmilegar hjį OR

- "Orkuveita Reykjavķkur skuldar um 240 milljarša króna, og eru skuldirnar ķ erlendum gjaldmišlum aš nęr öllu leyti."

- "80 prósent af tekjum fyrirtękisins eru hins vegar ķ krónum."

- "Eigiš fé fyrirtękisins hefur brunniš upp frį hruni."

- "Ķ minnisblaši sem fjįrmįlastjóri borgarinnar kynnti nżlega kemur fram aš 20% hękkun gjaldskrįr mundi ašeins duga til žess aš męta afborgunum žessa įrs."

- "Įn gjaldskrįrhękkana muni rekstrarafkoman ašeins nęgja fyrir greišslu um 90% af afborgunum og vöxtum žessa įrs, 64% af greišslubyrši nęsta įrs, 65% af greišslubyrši įrsins 2012 en aš Orkuveitan muni ašeins rķsa undir 44% af afborgunum og vaxtagreišslum įriš 2013 aš óbreyttu."

- "Ķ tengslum viš ašalfund fyrirtękisins žar sem nż stjórn var kjörin kom fram aš borgarstjórn ętlašist til aš virkri stórišjustefnu Orkuveitunnar yrši hętt. Um žaš hvaš žetta feli ķ sér segir Haraldur Flosi, fulltrśi Besta flokksins: „Žaš er opinber stefna žeirra sem ég žigg umboš mitt frį aš žaš eigi aš hverfa frį įhęttusękinni fjįrfestingu og snśa sér aš öruggri fjįrfestingu ķ žįgu almennings."

- "Stašiš verši viš skuldbindingar sem žegar hefur veriš stofnaš til en ekki efnt til nżrra fjįrfestinga. Um fjórir til sex milljaršar króna hafa fariš ķ aš undirbśa nżjar virkjanir į Hellisheiši, žar af um milljaršur ķ Bitruvirkjun, sem blįsin var af į sķšasta kjörtķmabili. Mun meira fé liggur ķ undirbśningi Hverahlķšarvirkjunar. Orkuveitan hefur įtt ķ višręšum um aš selja orku frį Hverahlķš til kķsilmįlmsverksmišju ķ Žorlįkshöfn og til įlvers ķ Helguvķk. Žau verkefni, og žar meš sala į orku Hverahlķšarvirkjunar, eru ķ óvissu enn sem komiš er. Haraldur Flosi leggur įherslu į aš stašiš verši viš geršar skuldbindingar gagnvart žessum ašilum en segir aš engin önnur įform séu um aš Orkuveita Reykjavķkur rįšist ķ įhęttusamar stórišjufjįrfestingar undir stjórn hins nżja meirihluta ķ borgarstjórn Reykjavķkur."

Sjį upplżsingar śr Fjįrhagsįętlun Reykjavķkurborgar 2010. Bls. 114 - 116.

2008 2009 2010

Skuldir. 211.014.534 240.859.954 250.943.959

Handbęrt fé* -2.507.372 -71.375 -433.021 (tölur yfir lękkun į handbęru fé)

Handbęrt fé** 3.751.011 1.243.639 1.172.264 (tölur yfir handbęrt fé ķ upphafi įrs)

Handbęrt fé 1.243.639 1.172.264 739.243 (Handbęrt fé ķ įrslok)

- Eins og sést aš ofan, er OR stöšugt nś aš éta upp sitt lausafé.

- Augljóslega, gengur slķkt ekki nema ķ skamman tķma.

Nišurstaša

- Ég er įnęgšur meš, aš nśverandi meirihluti sé aš vinna allsherjar śttekt - og, aš auki aš žeirri įhęttusömu fjįrfestingarstefnu er fylgt hefur veriš um nokkurrt įrabil, verši hętt.

- Betra seint en aldrei - en, eftir sytur borgin meš sįrt enniš. Valkostirnir einungis slęmir.

- Grķšarlegar hękkanir gjaldskrįr Orkuveitu Reykjavķkur, į nęstu įrum.

- Reykjavķkurborg, taki hluta skulda Orkuveitu Reykjavķkur yfir, létti žeim žannig af OR.

Bįšir kostirnir skila slęmri nišurstöšu, ž.e. vališ er:

- Auknar įlögur į almenning, og žaš stórfelldar. Į mešan getur almenningur ķ reynd engu į sig bętt.

- Auka skuldir Reykavķkur og žar meš vaxtagjöld Borgarsjóšs, sem mun minnka svigrśm borgarinnar til aš, standa undir kosningaloforšum um aukningu fjįrmagns til margra žarfra hluta.

Žessi nišurstaša er mikill įfellisdómur fyrir žį er hafa setiš ķ stjórn Orkuveitu Reykjavķkur umlišin įr, og žeir hafa veriš fulltrśar allra hinna hefšbundnu flokka. Stefna žeirra er réšu OR var žannig blessuš af fulltrśum allra sytjandi flokka į sķšustu 2. kjörtķmabilum.

Žaš veršur aš koma ķ ljós, hvaš nż Borgarstj. gerir į endanum ķ mįlinu, ž.e. A)Stórfelldar įlögur į almenning eša B)Gefa upp į bįtinn kostnašarsöm kosningaloforš er stušla įttu aš minnkušu atvinnuleysi ķ borginni og ķmsum öšrum jįkvęšum en kostnašarsömum breitingum.

Kv.

9.7.2010 | 00:37

Hversu slęmt vęri, ef Ķsland fęri ķ greišslužrot? Spurning sem vaknar aftur, žegar į nż er śtlit fyrir hrun bankakerfisins!

Žaš ganga margir mjög langt ķ fullyršingum -

- Hér verši Kśpa noršursins.

- Ķsland yrši lokaš af frį alžjóšamörkušum fyrir fullt og allt.

- Hér yrši fįtękranżlenda.

- Fyrirtękin flyttust burt.

- Žaš allra versta sem geti komiš fyrir.

- Žjóšir heims myndu snśa viš okkur baki.

Į VOXEU er aš finna įhugaverša grein, sem fjallar einmitt um žį spurningu, hverjar eru afleišingar greišslužrots.

The costs of sovereign default: Theory and reality

Eduardo Borensztein Ugo Panizza

Ašalgreinina žeirra, en greinin ķ VOXEU er stutt samantekt, sjį (Įhugasamir lesi sig ķ gegnum löngu greinina):

The Costs of Sovereign Default, Eduardo Borensztein and Ugo Panizza

Eins og žeir śtskżra, žį er almennt séš ekki hęgt aš ganga aš eignum rķkja eins og ef um fyrirtęki eša einstakling vęri aš ręša. Žetta sé vegna prinsippsins " sovereign immunity " ž.e. sem gjarnan er žķtt sem "grišhelgi".

Sovereign debt is different. Private debt contracts can be enforced in court and court rulings enforced by asset seizures. By contrast, public-debt creditors:

- Lack procedures for enforcing sovereign debt contracts – partly due to the principle of sovereign immunity.

- Have ill-defined claims on the sovereign's assets as they cannot attach assets located within the sovereign’s borders, and typically have limited success in going after sovereign assets located abroad.

Žetta vęntanlega skżrir fyrir einhverjum žeim er ekki vissi, af hverju įkvęšiš "Waiver of sovereign immunity" ķ Icesave samningnum, var svo alvarlegt.

Icesave samningurinn, er hefšbundinn višskiptasamningur. Er žaš gott?

Samingurinn viš upphaflegur texti: Holland

Samningurinn viš upphaflegur texti: Bretland

17.3 Waiver of sovereign immunity

Each of the Guarantee Fund and lceland consents generally to the issue of any

process in connection with any Dispute and to the giving of any type of relief or

remedy against it, including the making, enforcement or execution against any of its

property or assets (regardless of its or their use or intended use) of any order or

judgment. lf either the Guarantee Fund or lceland or any of their respective property or assets is or are entitled in any jurisdiction to any immunity from service of process or of other documents relating to any Dispute, or to any immunity from jurisdiction, suit, judgment, execution, attachment (whether before judgment, in aid of execution or otherwise) or other legal process, this is irrevocably waived to the fullest extent permitted by the law of that jurisdiction. Each of the Guarantee Fund and lceland also irrevocably agree not to claim any such immunity for themselves or their respective property or assets.

En žar var žeirri vörn sem fylgir sjįlfstęšinu, varpaš af eignum ķ eigu rķkisins - sem hefši algerlega umturnaš hinni žjóšréttarlegu stöšu Ķslands gagnvart Bretum og Hollendingum, ž.e. skv. žvķ įkvęši gįtu Hollendingar og Bretar raunverulega gengiš aš eignum ķslenska rķkisins, alveg eins og ef Ķsland vęri fyrirtęki eša einstaklingur, er hęgt vęri aš gera upp.

Munum, aš Icesave samningurinn var į einkarréttar grunni, og žannig raunverulega komiš fram viš Ķsland, eins og žaš vęri fyrirtęki eša einstaklingur, meš cirka sömu réttarstöšu - ž.e. ekki į grundvelli žjóšarréttar, ž.s. réttarstašan er allt, allt önnur.

- Ef, Icesave samningurinn hefši gengiš fram, hefši raunverulega veriš alltof - alltof, hęttulegt fyrir Ķsland aš fara ķ žrot.

- En, ž.s. honum var ķ reynd hafnaš, gilda enn hin hefšbundnu įkvęši hins alžjóšlega žjóšréttar, ž.e. eignir ķsl. rķkisins eru grišhelgar ž.e. hafa " sovereign immunity "

Ž.e. einmitt grišhelgin, sem gerir greišslužrot aš leiš sem er raunverulega fęr, fyrir fullvalda rķki.

- Ž.e. žjóšir hętta aš borga af skuldum.

- Į móti, hrynur lįnstraust alveg - hiš minnsta um tķma.

- Allur innflutningur žarf aš fara fram į grunni stašgreišsluvišskipta.

- En hversu lengi stendur žetta įstand, öllu aš jafnaši.

- Hve alvarlegar eru efnahagslegar afleišingar greišslužrots?

- Veršur viškomandi rķkjum aldrei fyrirgefiš?

Skemmtilegt aš skoša graf į bls. 28 ( The Costs of Sovereign Default, Eduardo Borensztein and Ugo Panizza ) ž.s. kemur fram yfirlit yfir fj. rķkja eftir heimsįlfum sem hafa lent ķ greišslužroti frį 1824 - 2004. Allar töflur birtar aftast.

Skošum hvaša svör Borenstein og Panizza gefa.

"We start with reputational costs and show that defaulting countries do indeed suffer in terms of access to the international capital markets. Default episodes are associated with an immediate drop of credit rating and a jump in sovereign spreads of approximately 400 basis points. However, this effect tends to be short lived and disappears between three and five years after the default episode."

- Meš öšrum oršum, svokallaš skulda-įlag hękkar um 400 punkta aš mešaltali, ž.e. CDS (credit default swap).

- Aš mešaltali, standa neikvęš įhrif yfir į milli 3 - 5 įr.

- En hafandi ķ huga kreppuna ķ 3. heiminum į 8. įratugnum, žį var mešaltķmi ögn lengri, ž.e. 9 įr.

When we look at trade costs, we add support to Rose's (2005) result that default episodes are associated with a drop in bilateral trade, but we are not able to identify the channel through which default has an effect on trade. In a companion paper (Borensztein and Panizza forthcoming), we also find a trade effect using industry-level data but, again, we find that the effect tends to be short lived and only lasts two to three years.

- Žeir finna aš višskipti skašast ķ tengslum viš greišslužrots višburši, en mešal tķmabil neikvęšra įhrifa į višskipti, séu ašeins 2-3 įr.

When we explore the effect of default on GDP growth, we find that, on average, default episodes are associated with a decrease in output growth of 2.5 percentage points in the year of the default episode. However, we find no significant growth effect in the years that follow the default episode. In fact, quarterly data indicate that output contractions tend to precede defaults and that output starts growing after the quarter in which the default took place (Levy et al. forthcoming). This suggests that the negative effects of a default on output are likely to be driven by the anticipation of default.

- Mešal-lękkun hagvaxtar sem hlutfalls landsframleišslu ķ tengslum viš greišslužrots višburši, skv. žeirra śtreikningum er einungis 2,5%.

- Žeir verša ekki varir viš nein merki umtalsveršra neikvęšra įhrifa į hagvöxt, įrin į eftir greišslužroti.

- Neikvęš įhrif komi fram, skv. greiningu į gögnum, rétt fyrir greišslužrot ž.e. aš orsök falls ķ hagvexti sé ekki greišslufalliš sjįlft heldur sé hana aš finna öllu jafnaši ķ žeirri röš atburša sem kemur į undan greišslufalli.

Nišurstaša

Ég er ekki aš hvetja til žess, aš leiš greišslužrots verši farin. Į hinn bóginn, viršist ljóst aš flest ž.s. haldiš er į lofti af žeim, er mįla mjög dökka mynd af lķklegum afleišingum greišslužrots, sé žvęttingur.

- Įbendingin er sś, aš greišslužrot er raunverulegur valkostur.

- Viš eigum ekki aš vera logandi hrędd viš žį hugsanlegu śtkomu.

- Aš mörgu leiti, erum viš betur ķ stakk bśin aš feta žį leiš en mörg önnur lönd, ž.s. Ķsland bżr yfir traustum tekjuleišum sem ólķklegt er aš muni raskast.

- Viš eigum einfaldlega aš ķhuga stöšuna, verandi ķ andlegu jafnvęgi.

- Žaš aš viš höfum žetta sem raunhęfa varaleiš, į aš styrkja stöšu okkar ķ samningavišręšum viš erlendar bankastofnanir, og jį - Breta og Hollendinga.

Ég met stöšuna žannig, aš enn sé mögulegt aš komast hjį žessu. Einnig, aš betra sé aš komast hjį žessu, - en į hinn bóginn mega ekki tilraunir til žess kosta of mikiš. Ef kalt mat er aš, hagstęšara sé aš neita aš borga, eigum viš aš feta žį vegferš óhrędd.

Žaš mun hafa nokkrar óžęgilega afleišingar - ekki mį heldur gleima aš žaš mį vera, aš Ķslandi vegni ver en mešaltölur aš ofan, gefa til kinna. En, samt vęrum viš ekki aš tala um neitt sambęrilegt viš žęr dökku myndir sem ķmsir viršast hafa gaman af, aš draga upp.

- En, žvķ mį ekki gleima aš skuldirnar hlaupa ekki frį okkur žó viš neitum aš borga žęr -

- Į hinn bóginn, verša eigendur skulda yfirleitt samningsžķšari eftir nokkurn tķma.

- Į endanum, ef menn vilja aftur öšlast lįnstraust žarf aš nį samningum viš kröfuhafa. En, žaš mį alveg taka einhvern tķma.

Ps. fer nś ķ sumarfrķ ķ viku. Sjįumst eftir viku.

Kv.

Stjórnmįl og samfélag | Breytt s.d. kl. 11:08 | Slóš | Facebook | Athugasemdir (2)

7.7.2010 | 15:49

Bankarnir meš svipašann innlendan starfsmannafjölda og žegar bóluhagkerfiš var ķ hįmarki įriš 2007

Arion Banki Ķslands Banki NBIHagnašur eigin fjįr 16,7% 35,3% 10%

Eiginfjįrhlutfall višskiptabankanna skv. Sešlabanka Ķslands.Arion Banki - 13,7%

Ķslandsbanki - 19,7%

NBI - 15%

MP banki 15,1%

Samtals 15,9%“

Žį viršist žaš klįrt, aš Ķslands Banki sé fjįrhagslega besti bankinn.

Žį vęri ef til vill réttast, aš sameina bankana meš žeim hętti, aš Ķslands Banki taki yfir NBI og Arion Banka, eša žį aš žeir 2 bankar fari ķ žrot og sķšan Ķslands Banki taki yfir žeirra eignir.

Skżrsla Bankasżslu Rķkisins "Ytra umhverfi fjįrmįlafyrirtękja hefur tekiš miklum stakkaskiptum frį bankahruni en lengri tķma tekur aš breyta innvišum. Žrįtt fyrir bankahruniš er hlutfall starfsmanna ķ fjįrmįlažjónustu sem hlutfall af heildarvinnuafli svipaš og žaš var įriš 2007 er stefnt var aš žvķ aš gera Ķsland aš alžjóšlegri fjįrmįlamišstöš,"

Stašfest af Bankasżslunni, aš innlendur starfsmannafj. sé svipašur og 2007 - ž.e. žegar starfsmfj. nįši hįmarki eftir hraša ženslu ķ fj. starfsmanna mešan bóluhagkerfiš var aš blįsa upp, frį 2004 fran aš hruni október 2007. Einungis viršist hafa fękkaš um starfsm. SPRON - starfsemi žess banka er lagšist aš stórum hluta nišur.

Eins og kemur fram į bls. 34 ķ annarri endurskošunar-skżrslu AGS, sjį hlekk aš nešan, er stęrš endurreists bankakerfis į Ķslandi, 159% af įętlašri stęrš hagkerfisins.

- Stašfest er sem sagt, aš bankakerfiš sé enn alltof stórt.

- Žetta veršur aš laga.

- Žvķ aupplįsiš umfang er augljóslega hķt fyrir fjįrmagn, og alveg örugglega orsakažįttur ķ vandręšum bankanna viš žaš aš finna fjįrmagn til aš framkvęma naušsynlegar afskriftir lįna.

Nišurstaša

Stašfest er, aš bankakerfiš er alltof stórt mišaš viš ašstęšur. Ljóst viršist aš viš erum aš stefna ķ annaš sinn fram af bjargbrśn. En, jafnvel nś į elleftu stundu mį vera aš enn sé hęgt aš bjarga mįlum ķ horn. En, skjótra og įkvešinna ašgerša er žį žörf.

Nśverandi stefna, aš lįta Hęstarétt skera śr um hverjir vextir hluta af lįnasafni bankanna eiga aš vera, er ķ besta falli bišleikur stjórnvalda. Hann gefur ekki mikinn višbótar tķma.

Vęntanlega mun Hęstiréttur stašfesta hiš augljósa, ž.e. aš engin lög heimili aš vķkja til hlišar vaxtaįkvęšum gildandi samninga, ž.e. samningsvextir standi.

Sennilega er e-h til ķ žvķ, aš žį komist bankakerfiš ķ vandręši. En, žetta er lķka annaš tękifęri til aš framkvęma naušsynlega endurskipulagningu bankamįla hérlendis.

Ž.e. naušsynlegt, aš meš žeim hętti verši unniš meš žetta - ž.e. śt frį žeirri forsendu, aš lįgmarka skaša fyrir almenning og hagkerfiš. Žaš veršur ekki gert meš įframhaldi nśverandi stefnu, heldur meš uppskurši bankakerfisins og endurreisn žess stórlegs smękkašs, en žį loks į styrkum fjįrhagslegum grunni.

Framkvęma veršur almennar ašgeršir fyrir skuldara, til aš skapa friš innan samfélagsins, en einnig sem hluta af almenndum efnahags ašgeršum til aš stušla aš hagvexti.

Kv.

Stjórnmįl og samfélag | Breytt s.d. kl. 21:00 | Slóš | Facebook | Athugasemdir (2)

6.7.2010 | 20:13

Žurfum aš įtta okkur į, viš stöndum į bjargbrśn annars hruns!

Hvernig stendur į aš viš viršumst aftur komin aš nokkurn veginn sama staš, og eftir hrun?

- Eins og ég sé žaš, žį liggja mistökin ķ žvķ, aš innlenda bankakerfiš var endurreist, nokkurn veginn eins og žaš, rétt fyrir hrun. Ž.e. - fyrir utan SPRON er hrundi og margir misstu žar vinnuna - er innlenda bankakerfiš nokkurn veginn meš sama starfsmannafjölda og fyrir hrun, en höfum ķ huga aš žį erum viš aš tala um śtžaninn starfsm.fj. bóluhagkerfisins aš slepptum žeim er störfušu erlendis. Skv. tölum AGS, er bankakerfiš ķ dag 1,59 falt hagkerfiš.

- Allur žessi fj. umfram brķna žörf, žiggur laun sem eru langt yfir lįgmarkslaunum, en laun bankamanna eru tiltölulega góš. Aš auki, er žaš rekstrar og stjórnunarkostnašur umfram brķna žörf.

- Žetta er verulegur peningur, sem dęmi er stęrsti hluti kostnašar Rķkisspķtala launakostnašur. Sjįlfsagt er žaš śt af fyrir sig göfugt markmiš aš halda fólki į launum, žannig aš žeirra fjölskyldur hafi nóg aš bķta og brenna. En, žennan pening hefši einnig veriš hęgt aš nota til aš sinna öšru og a.m.k. ekki minna göfugu markmiši.

Er žetta ekki einfaldlega peningurinn, sem hefši dugaš fyrir 20% leišinni, sem Framsóknarflokkurinn lagši til, um įriš?

Var žetta ekki lķka gróšinn, af fęrslu śtlįnapakka frį žrotabśum gömlu bankanna, yfir til žeirra nżju, į tuga prósenta afslętti? Žannig, aš sį gróši er nś uppeyddur?

------------------------------

Varšandi nśverandi deilu um gengistryggš lįn, var eftirfarandi haft eftir Steingrķmi J., Fjįrmįlarįšherra. Hann er eins og fram kemur, mikill lķšręšissinni :)

Steingrķmur J. og gengistryggš lįn

Steingrķmu"Steingrķmur J. Sigfśsson, fjįrmįlarįšherra, segir mikilvęgt aš fį

botn ķ žaš sem fyrst hvernig fara eigi meš gengistryggš lįn. Hann

segir hins vegar aš fariš verši eftir tilmęlum Sešlabankans og

Fjįrmįlaeftirlitsins um 8,5% prósent vexti žangaš til. Rįšherra segir

aš andstaša almennings hafi ekki įhrif į mįliš..."

„AGS einskonar skuggastjórnandi“

Lilja Mósesdóttir, sem er formašur višskiptanefndar,segir

Alžjóšagjaldeyrissjóšinn vera nokkurs konar skuggastjórnanda og

andstaša hans viš almenna nišurfellingu ķbśšalįna endurómi ķ stefnu

rķkisstjórnarinnar.

Ž.s. Lilja sagši, viršist vera kjarni mįlsins, ž.e. aš landinu sé ķ reynd stjórnaš af AGS.

Skv. žvķ sem mér hefur veriš sagt er žekktum erlendum ašilum, žį er AGS "very inverstor friendly organization".

Ž.e. mikil kaldhęšni ķ žvķ, aš fyrsta eiginlega vinstristjórnin hérlendis, fari žrįšbeint ķ žaš far, aš reka sérhagsmuni fjįrmįlamanna, eigenda fjįrmagns, og starfsmanna bankanna.

Į sama tķma, er hagsmunum almennings, vinnandi fólks, og barnafjölskylda, fórnaš.

-------------------------------

Viš sem erum ósįtt, žurfum samt sem įšur aš hugsa upp, hvernig vandinn veršur leystur:

- - žvķ ef ž.e. raunverulega satt, eins og Višskiptarįšherra, og nś Fjįrmįlarįšherra, segja.

- Žį, er bśiš aš eyša upp hagnašinum af yfirfęrslu lįnapakkanna, frį žrotabśum hrundu bankanna, yfir ķ žį nżju

- Žį stöndum viš frammi fyrir žeim grimma valkosti, aš taka bankana nišur ķ annaš sinn - ef til vill?

Viškomandi stašreyndum mį ekki heldur gleyma:

- Peningar verša ekki heldur bśnir til śr engu, ž.e. ef hagnašinum hefur veriš eytt, er sį peningur farinn fyrir fullt og fast.

- Žį er ef til vill eina leišin sem eftir er, til aš framkvęma žį nišurstöšu sem er skv. ķsl. lögum, og aš auki naušsynlega afskrift annarra lįna; aš minnka bankakerfiš um helming, og aš auki afskrifa öll innlįn fyrir umfram žak sem gęti veriš sett į bilinu 3-5 milljón per reikning.

Ž.e. aušvitaš ekki sanngjarnt ķ sjįlfu sér, aš rįšast aš innlįnseigendum, en žvķ mį ekki gleyma aš innlįn eru skuld bankans viš sérhvern innlįnseigenda - ž.e. innlįn eru skuldameginn hjį bönkunum.

- Ef eignastaša bankanna er hrunin, žeir eiga ekki fyrir naušsynlegum afskriftum, žį eru žeir pent gjaldžrota ķ reynd, sem einnig žķšir ekki er innistęša lengur fyrir hendi fyrir innlįnunum - hafandi ķ huga, aš lķklega er aš auki rķkiš ófęrt til aš endurtaka leikinn frį žvķ sķšast, og tryggja öll innlįn óhįš upphęš.

Nišurstaša

Viš stöndum meš öšrum oršum frammi fyrir valkostum, sem allir eru slęmir - og alveg sama hvaš veršur gert, śrlausn mįla getur ekki annaš en fališ ķ sér žaš aš einhverjir tapi.

- Einn valkosturinn, er žį aš halda įfram nśverandi stefnu, ž.e. neita aš afksrifa, aš ganga svo langt aš brjóta landslög til aš tryggja hagsmuni žeirra er starfa ķ bönkunum, žį į kostnaš restarinnar af almenningi. Žetta viršist leiš AGS og stj.v. - meš žį Gylfa og Steingrķm ķ fararbroddi.

- Annar vęri, aš fórna bankamönnum, ž.e. stórum hluta žeirra, einnig innlįnseigendum er eiga umfram 3-5 milljónir, einnig hagsmunum eigenda bankanna, en žess ķ staš verši hęgt aš nį fram sįtt viš almenning meš leišréttingum lįna nišur ķ žaš far ž.s. žau voru fyrir hrun - eša langleišina žangaš. Ljóst er, aš sś leiš er ķ andstöšu AGS og fjįrmįla-afla samfélagsins, og viršist rķkistj.

Ég efst um aš fyrri leišin sé fęr, ž.e. Hęstiréttur muni ķ annaš sinn einfaldlega dęma skv. landslögum, og žį standi lįnafyrirtęki žau er fara eftir tilmęlum stj.v. jafnvel frammi fyrir skašabótamįlum, fyrir utan önnur töp.

Žau hiš minnsta taka įhęttu ef žau kjósa aš fylgja tilmęlum stj.v. - er viršast brjóta landslög og ganga gegn dómi Hęstaréttar - ž.s. meš žvķ aš gera žetta einungis aš tilmęlum, varpa stj.v. įhęttunni af valinu yfir til žeirra, en vęntanlega var sś leiš valin vegna žess aš innst inni vita stj.v. aš spiliš er tapaš - en samt sem įšur, velja žau žann bišleik aš halda įfram.

Mį reyndar vera, -aš stj.v. skv. hótun Gylfa Magnśssonar og Steingrķms J. gagnvart almenningi- žį leitist viš aš fęra kostnaš af žeim ašgeršum į almenning, ž.e. stj.v. taki žann valkost aš dęla skattfé ķ bankana, til aš halda öllu į floti įfram óbreittu - sem augljóslega vęri einn bišleikurinn enn, hękki svo skatta og ašrar įlögur į móti - til žess vęntanlega aš gersamlega aš kaffęra atvinnulķfinu ķ sköttum. Sķšan, reyni žau enn um skeiš aš halda įfram stefnunni, aš neita aš afskrifa. Reynt verši įfram aš halda öllum bankamönnum ķ vinnu - er ekki klįrt fyrir hverja rķkisstj. starfar? Bankamenn, fjįrmįlamenn og AGS. Aušvitaš, breytir slķk ašgerš engu öšru en žvķ, aš hruninu veršur frestaš ef til vill nokkra mįnuši ķ višbót - ž.e. ef almenningur einfaldlega pent gerir ekki uppreisn og sparkar öllu klabbinu ķ burtu.

Seinni leišin, sjį aš ofan, veršur alls ekki heldur aušveld, en hśn mun fela ķ sér algera endurskipulagningu bankakerfisins, verulega fjölgun atvinnulausra ž.s. sennilega helmingur bankamanna a.m.k. verša atvinnulausir - en, hugsanlega į móti, veršur hęgt aš nį sįtt viš almenning.

Kv.

4.7.2010 | 17:36

Hverjar eru įstęšur žess, aš bankakerfi Evrópu ramba į barmi žrots?

Ég fę reglulega sent analķsur frį bandarķska einka-stofnuninni Stratfor. Eins og gerist og gengur, eru žeirra analķsur mis įhugaveršar

En, um daginn fékk ég žessa fyrir nešan.

- Aš mķnu mati, er hśn svo frįbęr greining į grunnįstęšum fyrir vanda bankakerfa Evrópu, aš ég hef įkvešiš aš setja hana inn ķ žessa bloggfęrslu.

Ég hvet ykkur endilega til, aš hafa fyrir žvķ, aš lesa žetta ķ gegn.

-----------------------------------------Source of analyzis STRATFOR

Europe: The State of the Banking System (STRATFOR Analyzis)

ast six months, the eurozone has faced its biggest economic challenge to date — one sparked by the Greek debt crisis which has migrated to the rest of the monetary union. But well before the sovereign debt crisis, Europe was facing a full-blown banking crisis that did not seem any closer to being resolved than when it began in late 2008. With investors and markets focused on European governments’ debt problems, the banking issues have largely been ignored. However, the sovereign debt crisis and banking crisis have become intertwined and could feed off each other in the near future.

Analysis

July 1 is a milestone for eurozone banks, with 442 billion euros ($541 billion) worth of European Central Bank (ECB) loans coming due. The loans were part of the ECB’s one-year liquidity offering made in 2009, which was intended to help stabilize the banking system.

However, one year after the ECB provision was initially offered, the eurozone’s banks are still struggling, and now Europe’s banks must collectively come up with the cash roughly equivalent to Poland’s gross domestic product (GDP).

Fears regarding the potentially adverse consequences of removing ECB liquidity are gripping many European banks and, by extension, investors who were already panicked by the sovereign debt crisis in the Club Med countries (Greece, Portugal, Spain and Italy). These concerns are as much a testament to the severity of the eurozone’s ongoing banking crisis as to the lack of resolve that has characterized Europe’s handling of the underlying problems.

Origins of Europe’s Banking Problems

Europe’s banking problems precede the eurozone’s ongoing sovereign debt crisis and even exposure to the U.S. subprime mortgage imbroglio. The European banking crisis has its origins in two fundamental factors: euro adoption in 1999 and the general global credit expansion that began in the early 2000s. The combination of the two created an environment that inflated credit bubbles across the Continent, which were then grafted onto the European banking sector’s structural problems.

In terms of specific pre-2008 problems we can point to five major factors. Not all the factors affected European economies uniformly, but all contributed to the overall weakness of the Continent’s banking sector.

1. Euro Adoption and Europe’s Local Subprime Bubble

The adoption of the euro — in fact, the very process of preparing to adopt the euro that began in the early 1990s with the signing of the Maastricht Treaty — effectively created a credit bubble in the eurozone. As the adjacent graph indicates, the cost of borrowing in peripheral European countries (Spain, Portugal, Italy and Greece in particular) was greatly reduced due, in part, to the implied guarantee that once they joined the eurozone their debt would be as solid as Germany’s government debt.

In essence, euro adoption allowed countries like Spain access to credit at lower rates than their economies could ever justify based on their own fundamentals. This eventually created a number of housing bubbles across Europe, but particularly in Spain and Ireland (the two eurozone economies currently boasting the relatively highest levels of private-sector indebtedness). As an example, in 2006 there were more than 700,000 new homes built in Spain — more than the total new homes built in Germany, France and the United Kingdom combined, even though the United Kingdom was experiencing a housing bubble of its own at the time.

It could be argued that the Spanish case was particularly egregious because Madrid attempted to use access to cheap housing as a way to integrate its large pool of first-generation Latin American migrant workers into Spanish society. However, the very fact that Spain felt confident enough to attempt such wide-scale social engineering indicates just how far peripheral European countries felt they could stretch their use of cheap euro loans. Spain is today feeling the pain of a collapsed construction sector, with unemployment approaching 20 percent and with the Spanish cajas (regional savings banks) reeling from their holdings of 58.9 percent of the country’s mortgage market. The real estate and construction sectors’ outstanding debt is equal to roughly 45 percent of the country’s GDP.

2. Europe’s ‘Carry Trade’

“Carry trade” usually refers to the practice in which loans are taken in a low interest rate country with a stable currency and “carried” for investment in the government debt of a high interest rate economy. The European practice, which extended the concept to consumer and mortgage loans, was championed by the Austrian banks that had experience with the method due to their proximity to the traditionally low interest rate economy of Switzerland.

In the carry trade, the loans extended to consumers and businesses are linked to the currency of the country where the low interest loan originates. Because of this, Swiss francs and euros served as the basis for most of such lending across Europe. Loans in these currencies were then extended as low interest rate mortgages and other consumer and corporate loans in higher interest rate economies in Central and Eastern Europe. Since loans were denominated in foreign currency, when their local currency depreciated against the Swiss franc or euro, the real financial burden of the loan increased.

This created conditions for a potential economic maelstrom at the onset of the financial crisis in 2008 when consumers in Central and Eastern Europe saw their monthly mortgage payments grow as investors pulled out from emerging markets in order to “flee to safety,” leading these countries’ domestic currencies to fall. The problem was particularly dire for Central and Eastern European countries with a great amount of exposure to such foreign currency lending (see adjacent table).

3. Crisis in Central/Eastern Europe

The carry trade led Europe’s banks to be overexposed to Central and Eastern European economies. As the European Union enlarged into the former Communist sphere in Central Europe, and as security and political uncertainties in the Balkans subsided in the early 2000s, European banks sought new markets where they could make use of their expanded access to credit provided by euro adoption. Banking institutions in mid-level financial powers such as Sweden, Austria, Italy and even Greece sought to capitalize on the carry trade by going into markets that their larger French, German, British and Swiss rivals largely shunned.

This, however, created problems for the banking systems that became overexposed to Central and Eastern Europe. The International Monetary Fund and the European Union ended up having to bail out several countries in the region, including Romania, Hungary, Latvia and Serbia. And before the eurozone ever contemplated a Greek or eurozone bailout, it was discussing a potential 150 billion-euro rescue fund for Central and Eastern Europe at the urging of the Austrian and Italian governments.

4. Exposure to ‘Toxic Assets’

The exposure to various credit bubbles ultimately left Europe vulnerable to the financial crisis, which peaked with the collapse of Lehman Brothers in September 2008. But the outright exposure to various financial derivatives, including the U.S. subprime market, was by itself considerable.

While the Swedish, Italian, Austrian and Greek banking systems expanded into the new markets in Central and Eastern Europe, the established financial centers of France, Germany, Switzerland, the Netherlands and the United Kingdom dabbled in various derivatives markets. This was particularly the case for the German banking system, where the Landesbanken — banks with strong ties to regional governments — faced chronically low profit margins caused by a fragmented banking system of more than 2,000 banks and a tepid domestic retail banking market. The Landesbanken on their own face between 350 billion and 500 billion euros worth of toxic assets — a considerable figure for the 2.5 trillion-euro German economy — and could be responsible for nearly half of all outstanding toxic assets in Europe.

5. Demographic Decline

Another problem for Europe is that its long-term outlook for consumption, particularly in the housing sector, is dampened by the underlying demographic factors. Europe’s birth rate is at 1.53, well below the population “replacement rate” of 2.1. Exacerbating the demographic imbalance is the increasing life expectancy across the region, which results in an older population. The average European age is already 40.9, and is expected to hit 44.5 by 2030.

An older population does not purchase starter homes or appliances to outfit those homes. And if older citizens do make such purchases, they are less likely to depend as much on bank lending as first-time homebuyers. That means not just less demand, but that any demand will depend less upon banks, which means less profitability for financial institutions. Generally speaking, an older population will also increase the burden on taxpayers in Europe to support social welfare systems, dampening consumption further.

In this environment, housing prices will continue to decline (barring another credit bubble, which would of course exacerbate problems). This will further restrict lending activities because banks will be wary of granting loans for assets that they know will become less valuable over time. At the very least, banks will demand much higher interest rates for these loans, but that too will further dampen the demand.

The Geopolitics of Europe’s Banking System

Given these challenges, the European banking system was less than rock-solid even before the onset of the global recession in 2008. However, Europe’s response as a Continent to the crisis so far has been muted, with essentially every country looking to fend for itself. Therefore, at the heart of Europe’s banking problems lie geopolitics and “capital nationalism.”

Europe’s geography encourages both political stratification and unity in trade and communications. The numerous peninsulas, mountain chains and large islands all allow political entities to persist against stronger rivals and continental unification efforts, giving Europe the highest global ratio of independent nations to area. Meanwhile, the navigable rivers, inland seas (Black, Mediterranean and Baltic), Atlantic Ocean and the North European Plain facilitate the exchange of ideas, trade and technologies among the disparate political actors.

This has, over time, incubated a continent full of sovereign nations that intimately interact with one another but are impossible to unite politically. Furthermore, in terms of capital flows, European geography has engendered a stratification of capital centers. Each capital center essentially dominates a particular river valley where it can use its access to a key transportation route to accumulate capital. These capital centers are then mobilized by the proximate political powers for the purposes of supporting national geopolitical imperatives, so Viennese bankers fund the Austro-Hungarian Empire, for example, while Rhineland bankers fund the German Empire. With no political unity, the stratification of capital centers becomes more solidified over time.

The European Union’s common market rules stipulate the free movement of capital across the borders of its 27 member states. Theoretically, with barriers to capital movement removed, the disparate nature of Europe’s capital centers should wane; French banks should be active in Germany, and German banks should be active in Spain. However, control of financial institutions is one of the most jealously guarded privileges of national sovereignty in Europe.

One reason for this “capital nationalism” is that Europe’s corporations and businesses are far less dependent on the stock and bond market for funding than their U.S. counterparts, relying primarily on banks. This comes from close links between Europe’s state champions in industry and finance (for example, the close historical links between German industrial heavyweights and Deutsche Bank). Such links, largely frowned upon in the United States for most of its history, were seen as necessary by Europe’s nation-states in the late 19th and early 20th centuries because of the need to compete with industries in neighboring states. European states in fact encouraged — in some ways even mandated — banks and corporations to work together for political and social purposes of competing with other European states and providing employment. This also goes for Europe’s medium-sized businesses — Germany’s mid-sized businesses are a prime example — which often rely on regional banks they have political and personal relationships with.

Regional banks are an issue unto themselves. Many European economies have a special banking sector dedicated to regional banks owned or backed by regional governments, such as the German Landesbanken or the Spanish cajas which in many ways are used as captive firms to serve the needs of both the local governments (at best) and local politicians (at worst). Many Landesbanken actually have regional politicians sitting on their boards while the Spanish cajas have a mandate to reinvest around half of their annual profits in local social projects, tempting local politicians to control how and when funds are used.

Europe’s banking architecture was therefore wholly unprepared to deal with the severe financial crisis that hit in September 2008. With each banking system tightly integrated into the political economy of each EU member state, an EU-wide “solution” to Europe’s banking problems — let alone the structural issues, of which the banking problems are merely symptomatic — has largely evaded the Continent. While the European Union has made progress in enhancing EU-wide regulatory mechanisms by drawing up legislation to set up micro- and macro-prudential institutions (with the latest proposal still in the implementation stages), the fact remains that outside of the ECB’s response of providing unlimited liquidity to the eurozone system, there has been no meaningful attempt to deal with the underlying structural issues on the political level.

EU member states have, therefore, had to deal with banking problems largely on a case-by-case (and often ad hoc) basis, as each government has taken extra care to specifically tailor its financial assistance packages to support the most and upset the fewest constituents. In contrast, the United States — which took an immediate hit in late 2008 — bought up massive amounts of the toxic assets from the banks, swiftly transferring the burden onto the state.

Europe’s banking system obviously has problems, but exacerbating the problems is the fact that Europe’s banks know that they and their peers are in trouble. This is causing the interbank market to seize up and thus forcing Europe’s banks to rely on the ECB for funding.

The interbank market refers to the wholesale money market that only the largest financial institutions are able to participate in. In this market, the participating banks are able to borrow from one another for short periods of time to ensure that they have enough cash to maintain normal operations. Normally, the interbank market essentially regulates itself. Banks with surplus liquidity want to put their idle cash to work, and banks with a liquidity deficit need to borrow in order to meet the reserve requirements at the end of the day, for example. Without an interbank market there is no banking “system” because each individual bank would be required to supply all of its own capital all the time.

In the current environment in Europe, many banks are simply unwilling to lend money to each other, as they do not trust their peers’ creditworthiness, even at very high interest rates. When this happened in the United States in 2008, the Federal Reserve and Federal Deposit Insurance Corporation stepped in and bolstered the interbank market directly and indirectly by both providing loans to interested banks and guaranteeing the safety of the loans banks were willing to grant each other. Within a few months, the U.S. crisis mitigation efforts allowed confidence to return and this liquidity support was able to be withdrawn.

The ECB originally did something similar, providing an unlimited volume of loans to any bank that could offer qualifying collateral, while national governments offered their own guarantees on newly issued debt. But unlike in the United States, confidence never fully returned to the banking sector due to the reasons listed above, and these provisions were never canceled. In fact, this program was expanded to serve a second purpose: stabilizing European governments.

With economic growth in 2009 weak, many EU governments found it difficult to maintain government spending programs in the face of dropping tax receipts. They resorted to deficit spending, and the ECB (indirectly) provided the means to fund that spending. Banks could purchase government bonds, deposit them with the ECB as collateral and walk away with a fresh liquidity loan (which they could use, if they so chose, to buy yet more government debt).

The ECB’s liquidity provisions were ostensibly a temporary measure that would eventually be withdrawn as soon as it was no longer necessary. So on July 1, 2009, the ECB offered the first of what was intended to be its three “final” batches of 12-month loans as part of a return to a more normal policy. On that day 1,121 banks took out a record total of 442 billion euros in liquidity loans (followed by another 75 billion euros taken out in September and 96 billion euros in December). The 442 billion euro operation has come due July 1. The day before, banks tapped the ECB’s shorter-term liquidity facilities to gain access to 294.8 billion euros to help them bridge the gap.

Europe now faces three problems:

- First, global growth has not picked up sufficiently in the last year, so European banks have not had a chance to grow out of their problems. This would have been difficult to accomplish on such a short timeframe.

- Second, the lack of a unified European banking regulator — although the European Union is trying to set one up — means that there has not yet been any pan-European effort to fix the banking problems. And even the regulation that is being discussed at the EU-level is more about being able to foresee a future crisis than resolving the current one. So banks still need the emergency liquidity provisions now as they did a year ago (to some degree the ECB saw this coming and has issued additional “final” batches of long-term liquidity loans). In fact, banks remain so unwilling to lend to one another that they have deposited nearly the equivalent amount of credit obtained from ECB’s liquidity facilities back into its deposit facility instead of lending it out to consumers or other banks.

- Third, there is now a new crisis brewing that not only is likely to dwarf the banking crisis, but could make solving the banking crisis impossible. The ECB’s decision to facilitate the purchase of state bonds has greatly delayed European governments’ efforts to tame their budget deficits. There is now nearly 3 trillion euros of outstanding state debt just in the Club Med economies — vast portions of which are held by European banks — illustrating that the two issues have become as mammoth as they are inseparable.

There is no easy way out of this imbroglio. Reducing government debts and budget deficits means less government spending, which means less growth because public spending accounts for a relatively large portion of overall output in most European countries. Simply put, the belt-tightening that Germany and the markets are forcing upon European governments likely will lead to lower growth in the short term (although in the long term, if austerity measures prove credible, it should reassure investors of the credibility of the eurozone’s economies). And economic growth — and the business it generates for banks — is one of the few proven methods of emerging from a banking crisis. One cannot solve one problem without first solving the other, and each problem prevents the other from being approached, much less solved.

There is, however, a silver lining. Investor uncertainty about the European Union’s ability to solve its debt and banking problems is making the euro ever weaker, which ironically will support European exporters in the coming quarters. This not only helps maintain employment (and with it social stability), but it also boosts government tax receipts and banking activity — precisely the sort of activity necessary to begin addressing the banking and debt crises. But while this might allow Europe to avoid a return to economic recession in 2010, it alone will not resolve the European banking system’s underlying problems.

For Europe’s banks, this means that not only will they have to write down remaining toxic assets (the old problem), but they now also have to account for dampened growth prospects as a result of budget cuts and lower asset values on their balance sheets due to sovereign bonds losing value.

Ironically, with public consumption down as a result of budget cuts, the only way to boost growth would be for private consumption to increase, which is going to be difficult with banks wary of lending.

The Way Forward?

So long as the ECB continues to provide funding to the banks — and STRATFOR does not foresee any meaningful change in the ECB’s posture in the near term or even long term — Europe’s banks should be able to avoid a liquidity crisis. However, there is a difference between being well-capitalized but sitting on the cash due to uncertainty and being well-capitalized and willing to lend. Europe’s banks are clearly in the former state, with lending to both consumers and corporations still tepid.

In light of Europe’s ongoing sovereign debt crisis and the attempts to alleviate that crisis by cutting down deficits and debt levels, European countries are going to need growth, pure and simple, to get out of the crisis. Without meaningful economic growth, European governments will find it increasingly difficult — if not impossible — to service or reduce their ever-larger debt burdens. But for growth to be engendered, the Europeans are going to need their banks, currently spooked into sitting on liquidity, to perform the vital function that banks normally do: finance the wider economy.

As long as Europe faces both austerity measures and reticent banks, it will have little chance of producing the GDP growth needed to reduce its budget deficits. If its export-driven growth becomes threatened by decreasing demand in China or the United States, it could also face a very real possibility of another recession which, combined with austerity measures, could precipitate considerable political, social and economic fallout.

---------------------------------------------------Analyzis from STRATFOR.

Aš mķnu mati frįbęr analķa.

Kv.

3.7.2010 | 09:20

Rķkissjóšur Ķslands er meš hęstu vaxtagreišslur sem hlutfall af eigin tekjum, af rķkissjóšum allra OECD rķkja!

Gylfi Magnśsson, hefur margķtrekaš boriš stöšu rķkissjóšs Ķslands saman viš stöšu rķkissjóša annarra Evrópulanda, ekki sķst stöšu Bretlands, og įlyktaš aš skuldastaša rķkissjóšs Ķslands sé ekki ósambęrileg - eša, ekki aš rįši verri.

- Įlyktunin sem hann hefur af žvķ dregiš, hefur veriš sś aš ķslenska rķkiš muni rįša viš sķnar skuldir!

- Vandinn viš žetta er aš - višmišiš, skuldir sem hlutfall af landsframleišsu - segir ķ raun og veru ekki nema hluta af sögunni.

Ž.s. skiptir meira mįli, er hver akkśrat vaxtagjöld eru sem hlutfall af tekjum, enda lķkur į aš lönd séu aš greiša mishįa vexti af sķnum skuldum, sem dęmi er lķklegt aš Bretland sé aš fį betri vaxtakjör en litla Ķsland. Óhagstęš vaxtakjör aš sjįlfsögšu skekkja myndina, žannig aš rķki meš lęgra skuldahlutfall getur veriš meš hęrri vaxtagjöld samt sem įšur, ef lįn eru óhagstęš.

Hérna fyrir nešan er samanburšartafla skv. upplżsingum frį OECD ž.s. fram kemur samanburšur milli rķkja į vaxtagjöldum eftir įrum.

- Žar kemur klįrlega fram, aš vaxtagjöld Ķslands eru hęst - sem žķšir aš Ķsland er meš erfišustu raun-skuldastöšu allra rķkja innan OECD, žvķ Ķsland er meš hęsta kostnašinn af sķnum skuldum.

- Takiš eftir, aš okkar vaxtagjöld eru verulega hęrri en vaxtagjöld Grikklands, sem Žó allir eru sammįla um ķ dag, aš sé gjaldžrota land.

En, eins og kemur einnig skżrt žarna fram, er megniš af skuldunum komnar til fyrir tilverknaš hrunsins, og ef fólk hefur veriš aš fylgjast meš žį er einmitt vandi okkar, ž.e. eitt af vandamįlunum, aš stór lįn voru tekin į mjög óhagstęšum tķma mitt ķ alžjóšlegu fjįrmįlakreppunni, žegar lįnakjör voru mjög óhagstęš - og endušum viš žvķ meš hį lįn į mjög dżrum kjörum - t.d. lįniš til endurfjįrmögnunar Sešlabanka. Viš įttum žvķ mišur ekkert val um annaš, žegar ķ óefni var komiš, en aš taka žau óhagstęšu lįn.

- Afleišingin er - eins og kemur fram aš nešan - mjög hį vaxtagjöld.

Vandinn viš svo hį vaxtagjöld, er aš žar meš hefur rķkiš minna fé til aš standa undir naušsynlegri žjónustu, og til aš reka sjįlft sig - og aš auki, minna til aš standa undir uppbyggingu ķ framtķšinni.

Alex Jurshevski - sagši į eigin bloggi, sjį " Why Iceland Must Vote “No” " - Um AGS lįnapakkann, aš "If the package were to be adopted the share of debt servicing out of total government revenues would top 16%. At those levels this statistic is more usually associated with extreme sovereign default risk. "

Ž.s. hann er aš vķsa til, aš ž.e. mjög erfitt aš bśa viš žaš aš svo hįtt hlutfall rķkistekna fari beint śr landi, engum ķ landinu til góšs. Rekstur viš slķkar ašstęšur, veršur mjög erfišur.

Alex Jurshevski į Pressunni, segir "Evrópa vaknar upp viš vondan skuldadraum...er Ķsland ennžį sofandi?" - Viš skošun į meira en 140 tilraunum til žess aš draga saman rķkisśtgjöld ķ žróušum rķkjum OECD koma nokkrar nišurdrepandi stašreyndir ķ ljós:

 Ķ meirihluta tilvika var fariš ķ flatan nišurskurš žar sem fjįrlög voru skyndilega skorin nišur um 1-4% af vergri landsframleišslu į einu įri. Žetta er svipaš og gert hefur veriš į Ķslandi frį 2008.

 Ķ flestum tilvikum batnaši fjįrhagsstašan ašeins um 2% af vergri landsframleišslu (mišgildi nišurstašna) og ķ flestum tilvikum varši ašhaldiš ašeins ķ tvö įr; og

 nęstum 66% af nišurskuršarašgeršunum voru įlitnar misheppnašar og ķ flestum tilvikum hafši įrangurinn aš mestu leyti horfiš innan žriggja įra.

Jurshevski bendir į aš flatur nišurskuršur, sé mjög gölluš ašferš:

- En, sem dęmi, ef stofnanir eru skikkašar til aš skera nišur t.d. 6% žetta įriš, 4% nęsta - sem dęmi, žį er hętta į aš žvķ sé einfaldlega komiš ķ framkvęmd meš žvķ einu, aš fresta endurnżjun tękja, višhaldi hśseigna - ķmsu slķku sem aušvelt er aš fresta tķmabundiš, - en slķkt er ekki raunverulegur sparnašur.

- Ef slķkum ašferšum er beitt, žį ešlilega sękir kostnašur aftur ķ sama fariš innan fįrra įra, žegar ekki er lengur hęgt aš fresta žeim žįttum, er tķmabundiš voru settir ķ frest.

- Raunverulegur nišurskuršur sé žolinmęšisvinna, ž.s. vanalega er um žörf į skipulagsbreytingum aš ręša.

- Fyrir utan žetta, er einna helst um žaš aš velja, aš hreinlega aš leggja einhverja starfsemi nišur.

Einst og sést aš ofan, til aš standa undir hinni grķšarlegu hękkun vaxtagjalda:

- Til samanburšar stendur til aš rķkissjóšur Grikklands nįi inn minnkun upp į um 11%.

- Meš enn hęrri vaxtagjöld, žį hlżtur aš žurfa aš spara hęrra hlutfall hérlendis.

IMF Reaches Staff-level Agreement with Greece on €30 Billion Stand-By Arrangement

A combination of spending cuts and revenue increases amounting to 11 percent of GDP—on top of the measures already taken earlier this year—are designed to achieve a turnaround in the public debt-to-GDP ratio beginning in 2013 and will reduce the fiscal deficit to below 3 percent of GDP by 2014.

Nišurstaša:

Viš Ķslendingar žurfum aš horfast ķ augu viš žaš, aš Ķslendingar allir - og hiš opinbera, verša į nęstu įrum, aš rifa seglin og žaš sem um munar.

- Flatur nišurskuršur, getur einungis veriš skammtķma neyšarašgerš.

- Sķšan, žarf aš taka viš śthugsašar ašgeršir, sem lśta aš žvķ aš nį fram sparnaši meš skipulagsbreytingum.

- En, einnig žurfum viš aš sętta okkur viš, aš žaš veršur naušsynlegt aš leggja nišur margvķslega starfsemi og žjónustu į vegum rķkisins og hins opinbera, og sennilega skerša žjónustu aš auki.

- Fyrir utan žetta, verša Ķslendingar sennilega fyrir frekari samdrętti ķ lķfskjörum.

Alls engin innistęša er fyrir launahękkunum į nęstu misserum, hvorki hjį rķkinu né hinu opinbera, og lķklega ekki heldur hjį atvinnulķfinu.

- Draumar um aš sękja aftur til baka žau lķfskjör er tapast hafa, verša aš bķša betri tķma - en, mjög sennilega, mun žaš taka langan tķma aš nį žeim hįpunkti hvaš lķfskjör varšar.

Fyrir utan sparnaš, veršur aš hrinda ķ framkvęmd ašgeršum, sem hjįlpa atvinnulķfinu og almenningi aš rétta viš sér.

- Lękkum vexti, og žaš stórlega, nišur ķ 1%. Engin ein ašgerš mun skila meiri hagsbótum fyrir hag heimila og fyrirtękja.

- Hvetjum einnig til śtflutnings, meš skattaķvilnunum til žeirra er annaš af tvennu, vilja hefja nżja śtflutningsstarfsemi, eša, hyggja į aš umbreyta fyrri starfsemi sinni ķ žaš horf aš žašan ķ frį skapi hśn gjaldeyristekjur.

Žessar ašgeršir, ęttu alveg aš geta dugaš til aš skapa sjįlfssprottinn hagvöxt.

- Aš auki vil ég leggja af verštryggingu, ž.s. hśn er mjög skašlegt fyrirbęri fyrir hagkerfiš, m.a. dregur hśn śr virkni vaxtatękisins viš hagstjórn og aš auki hvetur hśn til įhęttusękni žeirra er veita lįn. Aš auki, bitnar hśn mjög į almenningi.

- Sķšan, žarf aš finna leiš til aš afskrifa sem mest af lįnum, ég vil eina stóra almenna afskrift - segjum 30-35%.

Įsamt lękkun vaxta, og lķklegu raunverulegu upphafi hagvaxtar, žį ęttu žęr ašgeršir aš duga almenningi til žess, aš hann fari aš sjį einhverja vonarglętu ķ sortanum.

Kv.

Stjórnmįl og samfélag | Breytt s.d. kl. 11:54 | Slóš | Facebook | Athugasemdir (0)

1.7.2010 | 23:05

Nś hafa tveir Nóbelsveršlaunahafar tjįš sig um krónuna, ž.e. Paul Krugman og Joseph Eugene Stiglitz, og sagt hana gera okkur meira gagn en ógagn!

Tveir Nóbelsveršlaunahafar ķ hagfręši, hafa nś tjįš sig um mįlefni Ķslands og sagt krónuna gera okkur meira gagn en ógagn.

Hlustiš į Stiglitz: Stiglitz ķ Hįskóla Ķslands, fyrirspurnartķmi įsamt öšrum hagfr.

En, einhvern veginn, reikna ég samt ekki meš žvķ aš sannfęršir innan Samfylkingarinnar, skipti um skošun :)

Sjįum hvaš Krugman segir: The Icelandic Post-crisis Miracle

"Unlike other disaster economies around the European periphery – ...Iceland devalued its currency massively and imposed capital controls."

"And a strange thing has happened: although Iceland is generally considered to have experienced the worst financial crisis in history, its punishment has actually been substantially less than that of other nations."

-------------------------------------------------Töflurnar af blogginu hans Krugman

Sjį: The Icelandic Post-crisis Miracle

Eurostat

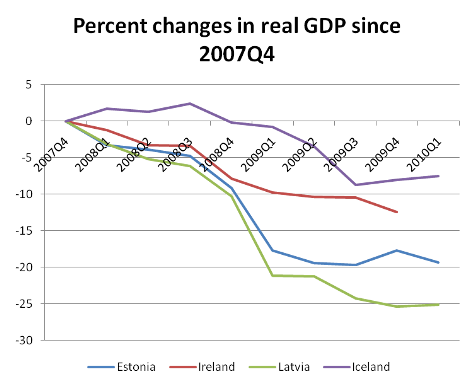

Eurostat- Žessi tafla sżnir, aš samdrįttur ķ landsframleišslu var langminnstur į Ķslandi.

Eurostat

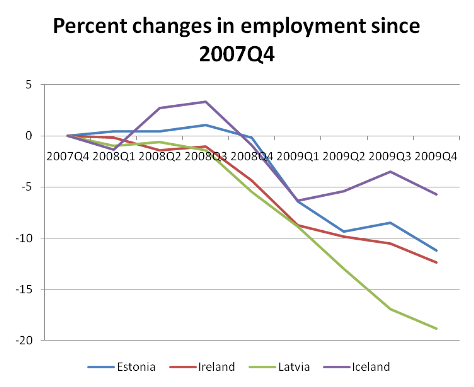

Eurostat- Žessi tafla sżnir aš aukning atvinnuleysis var langminnst į Ķslandi.

---------------------------------------------------------------Innskoti lokiš

Til įréttingar žess sem žegar er komiš fram, vil ég aftur vekja athygli į nišurstöšum sérfręšings hjį "Bank of International Settlements", ž.e. greining į efnahagslegum afleišingum stórfelldra gengisfellinga.

Žessi kafli, er undirkafli ķ nżjustu įrsfjóršungsskżrslu "Bank of International Settlements".

"Currency collapses and output dynamics: a long-run perspective"

Sjį hlekk: Quarterly Review - June 2010

Um rannsóknina:

- "This article presents new evidence on the relationship between currency collapses,,,and real GDP."

- "The analysis is based on nearly 50 years of data covering 108 emerging and developing economies."

- "...we identify a total of 79 episodes (Table 1). The threshold for a depreciation to qualify as a currency collapse is around 22%..."

Helstu nišurstöšur:

- "We find that output growth slows several years before a currency collapse, resulting in

sizeable permanent losses in the level of output."

- "On average, real GDP is around 6% lower three years after the event than it would have been otherwise."

- "However, these losses tend to materialise before the currency collapse."

- "This means that the economic costs do not arise from the depreciation per se but rather reflect other factors."

- "Quite on the contrary, depreciation itself actually has a positive effect on output."

- Growth tends to pick up in the year of the collapse and accelerate afterwards.

- Growth rates a year to three years after the episode are on average well above those one or two years prior to the event.

Hvaš meš Ķsland og krónuna?

Eins og kemur mjög skżrt fram aš ofan, kemur vandinn fram įšur en stór gengisfelling į sér staš -ž.e. atburšir er eiga sér staš į undan eru raunorsök.

- Į Ķslandi hafši gengi krónunnar hękkaš óešlilega mikiš - veriš óešlilega hįtt um nokkur įr og aš auki frį cirka 2004 til október 2008 var til stašar bóluhagkerfi ķ stöšugri śtženslu sem gat aš sjįlfsögšu ekki gengiš upp - žannig aš ljóst er aš gengishruniš var ekki orsök kreppunar sem skall į heldur rökrétt afleišing hruns bóluhagkerfisins.

Sķšan, hjįlpar gengisfellingin hagkerfinu ķ žvķ aš rétta śr kśtnum, ž.e. gengisfellingin flżtir fyrir aš hagkerfiš nįi sér af įfallinu.

- Ég held aš žaš sé alveg klįrt einnig af gögnunum frį Krugman, aš gengisfall krónunnar hefur hjįlpaš hagkerfinu.

En, er žį ekki krónan ónżt?

Viš veršum aš muna, aš gjaldmišillinn hvķlir į grunni hins undirliggjandi hagkerfis. Meš öšrum oršum, ef hagkerfiš er traust er gjaldmišillinn traustur, og öfugt. Svo, žį er fólk beinlķnis aš segja aš ķsl. hagkerfiš sé ónżtt.

En ž.e. alls ekki satt, en ž.s. hérlendis eru enn flutt śt veršmęti ž.e. įl og fiskur, aš auki höfum viš tekjur af feršamönnum; žį er hér enn starfandi hagkerfi. Žannig, aš gjaldmišillinn sem į žvķ hvķlir, getur ekki į mešan svo er, oršiš veršlaus.

Grunnvandi krónunnar liggur ķ žvķ aš ķsl. hagkerfiš hefur veriš sveiflukennt og aš auki ķ žvķ aš ķsl. hagstjórn hefur of oft veriš fremur léleg, žannig aš ķ staš žess aš tempra sveiflur hefur hśn magnaš žęr - sem hefur žį byrst ķ genginu sem stórar gengissveiflur.

Aš auki, er einnig vandi ķ sjįlfu ešli okkar framleišsluhagkerfis, ž.e. einhęft - śtflutningurinn einhęfur.

- Gengissveiflur verša oftast žannig, aš sveiflur verša ķ hagkerfinu.

- Leišin, til aš minnka sveiflurnar, er aš breyta sveiflutķšni sjįlfs hagkerfisins - sem žį gerir einnig krónuna stöšugari - reyndar mun žaš einnig skapa žau hlišarįhrif aš gera žaš aušveldara aš bśa viš annan gjaldmišil en krónu.

- Aš auki, žurfum viš aš bęta hagstjórn - žaš lķtur aš innlendum stjórnmįlum og žeim stofnunum sem hér hafa veriš upp byggšar.

Sjśkdómsgreiningin er sem sagt sś, aš gengissveiflur séu einkenni sjśkdóms sem eigi rót til sjįlfs grunnsins er allt hvķlir į, ž.e. framleišsluhagkerfiš - annars vegar - og hins vegar, ķ landstjórninni.

Réttur skilningur, er sķšan forsenda fyrir žvķ aš komast aš réttum lausnum.

- Pólitķkina žurfum viš einfaldlega aš laga, bęta vinnubrögš.

Hverskonar framleišsluhagkerfi, žrifust innan Evrunnar?

Žetta žarf ašeins aš skoša gagnrżnum augum, ž.e. fyrir hvaša hagkerfi Evran hefur virkaš hvaš best - ž.e. hagkerfi sem selja dżra hįtękni vöru fyrir mikinn pening per tonn.

Af hverju er žaš atriši? Ž.e. vegna žess, aš ef žś fęrš mikinn viršisauka fyrir žinn śtflutning, ž.e. varan į endanum veršur mjög mikiš veršmętari en ž.s. fer ķ hana af hrįefnum, žį skiptir sjįlft veršiš į gjaldmišlinum ekki lengur höfušmįli fyrir žinn śtflutning ž.e. samkeppnishęfni hans, einmitt vegna žess aš veršiš į gjaldmišlinum er žį svo lķtill hluti heildarveršmętaaukningar hrįefnanna.

Žannig, aš žį ber žitt framleišsluhagkerfi dżran gjaldmišil og žaš įn vandkvęša.

Ķslenska framleišsluhagkerfiš er mjög viškvęmt fyrir kostnašarhękkunum!

Ž.e. aftur į móti mjög klįrt, oftlega sannaš meš dęmum ž.s. krónan hękkar og śtflutningi hnignar - innflutningur veršur meiri aš veršmętum; aš ķsl. framleišsluhagkerfiš er mjög viškvęmt fyrir veršinu į gjaldmišlinum.

- Höfum ķ huga, aš ķ staš žess aš okkar ašalśtflutningur sé dżr tęki og ašrar hįtęknivörur, er hann ferskfiskur aš mestu óunninn og įl (ž.e. ekki vörur śr įli) - svo höfum viš feršamenn.

- Ž.s. ég er aš reyna aš segj, er aš frumstęši okkar framleišsluhagkerfis sé žarna til vansa, sem sést m.a. annars į lęrdómi S-Evrópu af žvķ aš bśa viš Evru.

En, įstęša žess aš framleišsluhagkerfum margra Evru-rķkja hnignaši undir Evrunni, er hśn hękkaši ķ verši - var akkśrat sś, aš eins og śtflutningur Ķslands, er śtflutningur žeirra landa einnig į mun lęgra viršisaukastigi veršmętalega en t.d. śtflutningur Žżskalands.

Žetta er atriši sem žarf aš skoša af mikilli alvöru, en eins og ég skil žetta, ž.s. Evran mišast viš Žżskaland og ž.s. Ķsl. framleišsluhagkerfiš er miklu mun vanžróašra, žį gildir eftirfarandi:

- Laun hér verša alltaf aš vera lęgri en ķ Žżskalandi, ķ samręmi viš aš hvaša marki viršisauki per tonn er lęgri hér į landi.

- Vegna žess, hve okkar framleišsluhagkerfi hnignar hratt ef innlendur kostnašur hękkar, verša laun aš lękka hérlendis eftir žvķ sem Evran hękkar ķ veršgildi.

- Laun mį hękka, ef Evran lękkar.

- Laun mį ekki hękka umfram aukningu framleišni ķ hagkerfinu, sem į sķšasta įratug var cirka 1,5% į įri.

Höfum ķ huga, aš žetta er mjög erfiš spennitreyja - aš auki, aš löndunum sem nś eru ķ vandręšum Evrópu, sem lentu ķ vķtahring vaxandi višskiptahalla og skuldasöfnunar, žeim tókst ekki aš aušsżna aga af žessu tagi - žannig aš žetta er raunverulega mjög - mjög erfitt ķ framkvęmd.

Höfum aš auki ķ huga, aš til žess aš žetta gangi upp, verša allir aš spila meš og ž.e. rķkiš, sveitarfélög og ašilar vinnumarkašarins. Ž.e. ekki sķst ž.s. er erfitt.

Ekki mį heldur gleyma žeim pólitķska vanda og stjórnkerfisvanda, sem hér hefur afhjśpast.

*******Ég hef ekki trś į aš žetta sé hęgt ķ framkvęmd.*******

Nišurstaša

Mynnumst žess, aš tveir Nóbelsveršlaunahafar hafa nś tjįš sig, og bent okkur į aš krónan žrįtt fyrir marga galla, sé samt aš vinna okkur gagn.

Mynnumst einnig krķsunnar ķ S-Evrópu, ž.s. land eftir landi, hefur lent ķ svipušum efnahagsvanda aš ķmsu leiti og Ķsland; ž.e. višskiptahalla - skuldasöfnun, bęši fyrirt. og almennings.

Minn lęrdómur af krķsunni ķ Evrópu tengdri Evrunni, er sem sagt sį aš žrįtt fyrir alla galla - sem trśiš mér ég žekki žį alla - sé enn meira gallaš fyrir okkur, aš bśa viš annan gjaldmišil en krónu; svo lengi sem okkar framleišsluhagkerfi er hvort tveggja ķ senn einhęft og "low tech".

Okkar innlenda stjórnkerfis- og stjórnmįlavanda, veršum viš einnig aš leysa. Annars er hann sjįlfstętt efnahags vandamįl.

Ég er aš segja, aš žeir sem gagnrżndu Evrópu śt frį žeirri forsendu, aš Evrópa vęri ekki "optimal currency area" vegna žess hve stór munur vęri į milli innbyršis samkeppnishęfni hagkerfa hennar, hafi haft rétt fyrir sér. Aš auki, er ég aš segja aš Ķsland sé klįrlega ķ lélega hópnum, ž.e. aš žaš sama eigi viš um okkur, aš Evran henti okkur ekki, né viršist sem hśn henti S-Evrópu.

Svo žarf ekki aš vera um aldur og ęfi. Viš getum breytt žessu. Gert okkar hagkerfi samkeppnishęft viš žróuš hagkerfi, og aš žvķ eigum viš aš stefna. Viš getum hugsanlega haft ž.s. langtķmamarkmiš, aš taka upp annan gjaldmišil - sem viš rįšum ekki yfir - t.d. 20 įra plan.

Sko, žaš sama og gerir okkur aušveldar um vik, aš lifa įfram viš krónuna, mun einnig skapa skilyrši fyrir žvķ aš taka upp annan gjaldmišil. Žaš veršur žį einfaldlega valkostur, A eša B.

- Žaš žarf aš hefja allsherjar og langtķmaįtak, til aš bęta framleišsluhagkerfiš.

- Žaš gengur ekki lengur, aš hafa framleišsluhagkerfiš sambęrilegt viš S-Evrópu og į sama tķma reyna aš halda uppi sama žjónustustigi og į Noršurlöndum.

- Ég er hręddur um, aš viš veršum aš fęra žjónustustig nišur į žaš plan sem framleišsluhagkerfiš ķ reynd stendur undir - og sķšan gera žaš aš langtķmaplani svona 20 įra plani, aš komast til baka.

- Sķšast en ekki sķst, bęta innlenda stjórnsżslu og stjórnun af hendi okkar stjórnmįla į hagkerfinu.

Kv.

Stjórnmįl og samfélag | Breytt 2.7.2010 kl. 22:08 | Slóš | Facebook | Athugasemdir (3)

Um bloggiš

Einar Björn Bjarnason

Nżjustu fęrslur

- Ég er eindregiš žeirrar skošunar - Ķsrael geti ekki unniš str...

- Trump, hefur višurkennt aš geta ekki greitt - 464 milljón dol...

- Skošanakannanir lķklega ofmeta fylgi Donalds Trumps -- sem er...

- 2 įr sķšan Rśssland hóf innrįs ķ Śkraķnu, febr. 2022: Strķšiš...

- Batnandi efnahagur Bandarķkjanna gęti bętt sigurlķkur Joe Bid...

- Hęstiréttur Bandarķkjanna, varšandi mįl Donalds Trumps - ętti...

- Arabarķki leggja fram frišartillögu ķ įtökum Ķsraels og Hamas...

- Yfirlit yfir stöšuna ķ Śkraķnu: Stuttu mįli sagt, gekk sókn Ś...

- Vegna mikillar umręšu um, vinsęldir Donalds Trump vs. óvinsęl...

- Haršir bardagar sl. 3 vikur um borgina Avdiivka ķ SA-Śkraķnu,...

- Er Ķsrael aš falla ķ gildru Hamas Samtakanna? Hamas samtökin ...

- Įrįs Hamas samtakanna frį Gaza svęšinu į Ķsrael - stęrsta bló...

- Stašfest gegnumbrot Śkraķnmanna, į Varnarlķnu Rśssar No. 2 --...

- Hafa Śkraķnumenn, žegar 'de facto' haft sigur į Rśssum ķ S-Śk...

- Nżleg könnun ķ Bandarķkjunum - sżnir, dómsmįlin ógna möguleik...

Eldri fęrslur

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

Bloggvinir

-

eyglohardar

eyglohardar

-

bjornbjarnason

bjornbjarnason

-

ekg

ekg

-

bjarnihardar

bjarnihardar

-

helgasigrun

helgasigrun

-

hlini

hlini

-

neytendatalsmadur

neytendatalsmadur

-

bogason

bogason

-

hallasigny

hallasigny

-

ludvikjuliusson

ludvikjuliusson

-

gvald

gvald

-

thorsteinnhelgi

thorsteinnhelgi

-

thorgud

thorgud

-

smalinn

smalinn

-

addabogga

addabogga

-

agnarbragi

agnarbragi

-

annabjorghjartardottir

annabjorghjartardottir

-

annamargretb

annamargretb

-

arnarholm

arnarholm

-

arnorbld

arnorbld

-

axelthor

axelthor

-

arnith2

arnith2

-

thjodarsalin

thjodarsalin

-

formosus

formosus

-

birgitta

birgitta

-

bjarnijonsson

bjarnijonsson

-

bjarnimax

bjarnimax

-

westurfari

westurfari

-

virtualdori

virtualdori

-

bookiceland

bookiceland

-

gattin

gattin

-

davpal

davpal

-

dingli

dingli

-

doggpals

doggpals

-

egill

egill

-

jari

jari

-

einarborgari

einarborgari

-

einarsmaeli

einarsmaeli

-

erlaei

erlaei

-

ea

ea

-

fannarh

fannarh

-

fhg

fhg

-

lillo

lillo

-

gesturgudjonsson

gesturgudjonsson

-

gillimann

gillimann

-

bofs

bofs

-

mummij

mummij

-

kallisnae

kallisnae

-

gp

gp

-

gudmbjo

gudmbjo

-

hreinn23

hreinn23

-

gudrunmagnea

gudrunmagnea

-

gmaria

gmaria

-

topplistinn

topplistinn

-

skulablogg

skulablogg

-

gustafskulason

gustafskulason

-

hallurmagg

hallurmagg

-

haddi9001

haddi9001

-

harhar33

harhar33

-

hl

hl

-

diva73

diva73

-

himmalingur

himmalingur

-

hjaltisig

hjaltisig

-

keli

keli

-

fun

fun

-

johanneliasson

johanneliasson

-

jonsullenberger

jonsullenberger

-

rabelai

rabelai

-

jonl

jonl

-

jonmagnusson

jonmagnusson

-

jonvalurjensson

jonvalurjensson

-

gudspekifelagid

gudspekifelagid

-

thjodarskutan

thjodarskutan

-

juliusbearsson

juliusbearsson

-

ksh

ksh

-

kristbjorg

kristbjorg

-

kristinnp

kristinnp

-

larahanna

larahanna

-

leifurbjorn

leifurbjorn

-

lifsrettur

lifsrettur

-

wonderwoman

wonderwoman

-

maggij

maggij

-

elvira

elvira

-

olafureliasson

olafureliasson

-

olinathorv

olinathorv

-

omarragnarsson

omarragnarsson

-

ottarfelix

ottarfelix

-

rafng

rafng

-

raksig

raksig

-

redlion

redlion

-

salvor

salvor

-

samstada-thjodar

samstada-thjodar

-

fullvalda

fullvalda

-

fullveldi

fullveldi

-

logos

logos

-

duddi9

duddi9

-

sigingi

sigingi

-

sjonsson

sjonsson

-

sigurjons

sigurjons

-

stjornlagathing

stjornlagathing

-

athena

athena

-

stefanbogi

stefanbogi

-

lehamzdr

lehamzdr

-

summi

summi

-

tibsen

tibsen

-

vala

vala

-

valdimarjohannesson

valdimarjohannesson

-

valgeirskagfjord

valgeirskagfjord

-

vest1

vest1

-

vignir-ari

vignir-ari

-

vilhjalmurarnason

vilhjalmurarnason

-

villidenni

villidenni

-

thjodarheidur

thjodarheidur

-

valli57

valli57

-

tbs

tbs

-

thorgunnl

thorgunnl

-

thorsaari

thorsaari

-

iceberg

iceberg

Heimsóknir

Flettingar

- Ķ dag (19.4.): 1

- Sl. sólarhring: 3

- Sl. viku: 758

- Frį upphafi: 846639

Annaš

- Innlit ķ dag: 1

- Innlit sl. viku: 694

- Gestir ķ dag: 1

- IP-tölur ķ dag: 1

Uppfęrt į 3 mķn. fresti.

Skżringar